by Louise Dunn

t is hard enough listening to your team question their pay rate and, coupled with the added pressure of following your state’s process of raising the minimum wage, it can become a nightmare as you hire a new team member at a rate close to your current team’s rate. In 2023, over 20 states raised their minimum wage, with new minimum rates ranging from $9.95 (Montana) to $15.74 (Washington).1

With the increase in minimum wage comes the obvious query from your team: “When are we getting a raise since minimum wage is now higher?” A receptionist earning $15/hr may have been reasonable in 2021, then along comes fast food workers in 2022 getting $15/hr and the state’s minimum increasing to $14/hr in 2023. Does that receptionist look for a wage increase beyond the typical cost of living adjustment? Add to that the rising inflation rate—and you must admit, is it any wonder why there seems to be a constant battle between what you pay and what the team wants?

t is hard enough listening to your team question their pay rate and, coupled with the added pressure of following your state’s process of raising the minimum wage, it can become a nightmare as you hire a new team member at a rate close to your current team’s rate. In 2023, over 20 states raised their minimum wage, with new minimum rates ranging from $9.95 (Montana) to $15.74 (Washington).1

With the increase in minimum wage comes the obvious query from your team: “When are we getting a raise since minimum wage is now higher?” A receptionist earning $15/hr may have been reasonable in 2021, then along comes fast food workers in 2022 getting $15/hr and the state’s minimum increasing to $14/hr in 2023. Does that receptionist look for a wage increase beyond the typical cost of living adjustment? Add to that the rising inflation rate—and you must admit, is it any wonder why there seems to be a constant battle between what you pay and what the team wants?

The strategy of structuring pay is more than simply what your team is paid to do and when they are paid. It involves following laws, checking industry norms and staying aware of local competition. It requires knowledge of your recruitment and retention numbers, strategic goals for the business and skills gaps among the team members. Given the importance of all these factors, it sounds as if it is easier to toss out a few hourly rates and call it a day. However, you may be putting the business at risk. Working with your accountant and other professionals (e.g., insurance brokers, attorneys, etc.) is essential to developing a pay strategy that is a win-win for everyone.

Once you know your strategy and the numbers you want to achieve, it is time for the rubber to meet the road. The most common action steps involve increasing fees and decreasing costs to improve business financials. The caveat: There is only so much clients are willing to pay for services, and there is only so much cost-cutting before sacrificing pet health and wellbeing. That does not mean to skip this step. Many businesses can find errors in data entries, mistakes in buy-to-sell ratios and vendors with better deals that improve the numbers. Start here and fix any problems before deciding on the next move.

Returning to the benchmark reports, compare your numbers with your colleagues and decide where to tweak some fees and improve some costs. Work with your accountant to produce “clean” data before taking action.

But what if you already are running a tight ship with your fees and costs, yet you still need a comfortable margin for raising your team’s pay? Look for opportunities!

The bottom line may not be IF you can afford to pay more, but rather, what is the consequence of not paying more? Are you increasing the risk of high employee turnover or trouble attracting new employees? Do lower wages hamper productivity? Does pet care and client service suffer due to a lack of staff or too many less-experienced people? While there is no right or wrong strategy, there are consequences, and you must be prepared to own your strategy.

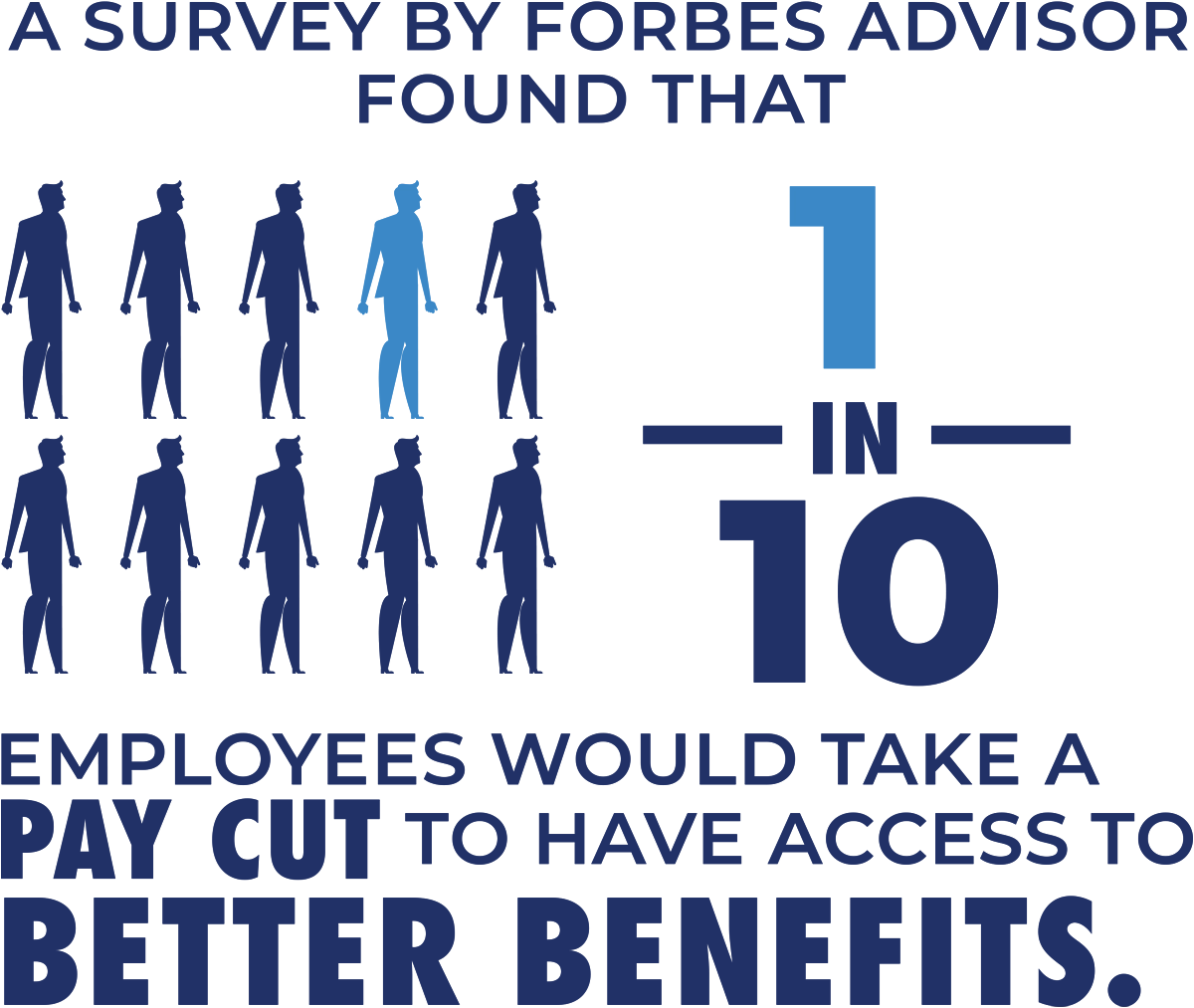

Again, money isn’t everything. Businesses that define career advancement and incorporate other benefits can provide balance to a less-than-desirable pay rate. A survey by Forbes Advisor found that 1 in 10 employees would take a pay cut to have access to better benefits.2 What else can help your business if a wage hike is not in the cards? Voluntary benefits (supplemental coverage at a low cost to the employee), mandatory paid time-off, pension and retirement plans, life insurance, remote work and/or flexible hours, stress management, mental health benefits, professional development, job advancement…the opportunities are endless.

The pet care profession is known for the level of care provided to animals of all shapes and sizes. It may be time to venture outside the box and care for the people providing that care.

- Biron, B. (2023, January 8). These are the states where the minimum wage is going up in 2023. Business Insider. https://www.businessinsider.com/minimum-wage-rising-23-states-2023-full-list-2022-12?op=1

- Miranda, D. (2023, February 6). Forbes Advisor. https://www.forbes.com/advisor/business/best-employee-benefits/